Empowering financial institutions to manage financed emissions

Addressing financed emissions is vital for compliance, driving sustainability work, and mitigating risk.

For financial institutions, the emissions from investments and assets (known as “financed emissions”) are 700 times larger than directly-generated emissions – making them vital to address. However, financed emissions are extremely challenging to calculate manually due to the complexity of financial value chains.

The latest product update from Normative automates the process of calculating financed emissions, empowering financial institutions to comply with legislation and turn their net-zero commitments into pragmatic, science-based action plans.

Automating financed emissions calculations

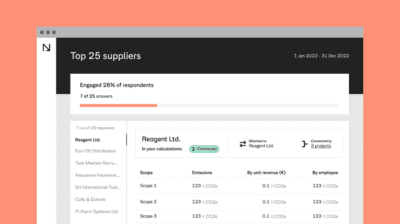

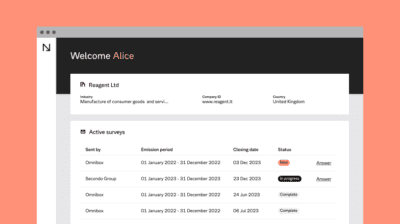

Normative leverages automation to improve the speed and accuracy of financed emissions calculations.

These comprehensive carbon calculations enable private equity firms, VC’s, and other financial institutions to report their emissions in alignment with frameworks like Partnership for Carbon Accounting Financials (PCAF) and Task Force on Climate-Related Financial Disclosures (TCFD) – keeping them compliant with mandatory disclosure requirements.

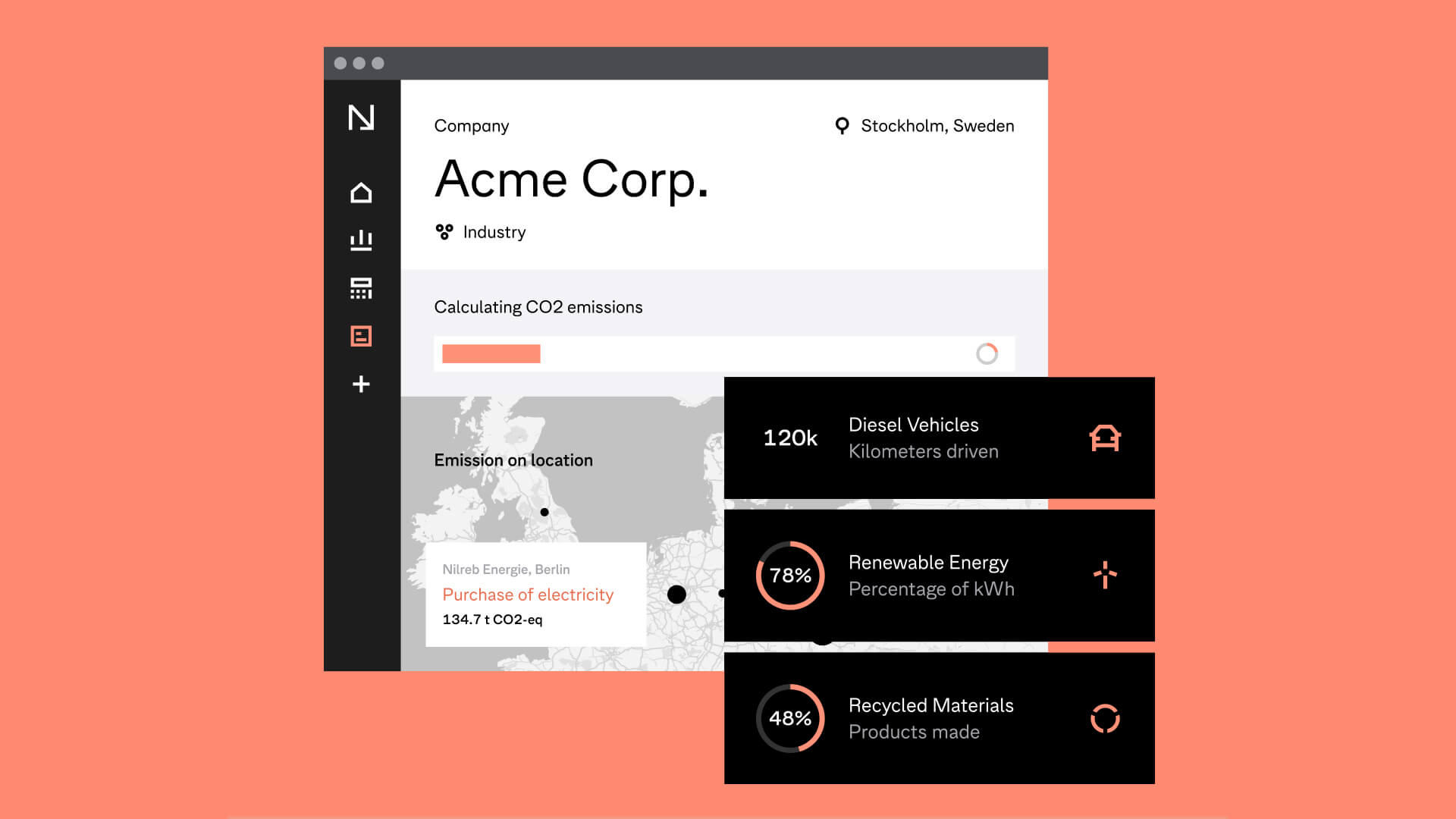

With the Normative carbon accounting engine, users can visualize their emissions data in dashboards tailored to financial institutions, as well as automatically export this data in a PCAF-compliant format.

In addition, the unparalleled accuracy of these calculations provides the foundation from which financial institutions can make immediate and verifiable carbon reductions throughout their portfolios.

What are financed emissions?

Financed emissions are the emissions that originate from a financial institution’s assets and investments.

For financial institutions, these emissions fall under the value chain – specifically, category 15 of scope 3 as defined by the Greenhouse Gas Protocol.

Why calculate financed emissions?

The finance sector – including banking, venture capital (VC), and private equity – faces strict climate disclosure requirements.

- The UK’s Streamlined Energy and Carbon Reporting (SECR) policy requires organizations to disclose carbon emissions information in their annual reports.

- In the EU, the Sustainable Finance Disclosure Regulation (SFDR) obligates financial market participants to report sustainability impact, including scope 3 emissions.

- The US Securities and Exchanges Commission (SEC) has proposed rules that would require climate-related disclosures for investors.

Complicating the task of disclosure is the intricate nature of financial value chains, which include emissions from sources like equity and debt.

To stay compliant with climate disclosure requirements, financial institutions need to comprehensively and efficiently calculate the carbon emissions from their investments and other financial activities.

“Financed emissions account for 98% of our total carbon footprint,” says Zoë VanderWolk, Investor Relations & Sustainability Manager at ETF Partners, a leading European climate-tech VC firm. “We need to address these emissions to stay compliant with reporting legislation, to understand the sources of risk in our portfolio, and to meet our climate goals.”

Automated carbon calculations

Normative’s carbon accounting engine automates the process of calculating emissions – including tricky-to-quantify financed emissions.