Carbon reporting legislation: an overview

Learn about the existing & future carbon reporting legislation relevant to your business

Carbon reporting legislation is expanding rapidly across the world. It’s tricky for businesses to stay on top of, and getting it wrong can result in harm to a business’s reputation – or even bring legal consequences.

Businesses that don’t comply risk hefty fines, reputational harm, and lawsuits. Additionally, non-compliant businesses may face the loss of government contracts, formal bids, or proposal requests.

However, in addition to being a legal requirement, carbon reporting is also an opportunity. Businesses, consumers, and investors have increasing demands for sustainable businesses. Meeting this demand, and proving it by going public with their results, allows companies to entice consumers, funding, and talent.

How do I know if I need to report my business’s carbon emissions?

For a business, carbon reporting can be legally mandated by the country or region the business operates in, required by investors, or demanded by customers.

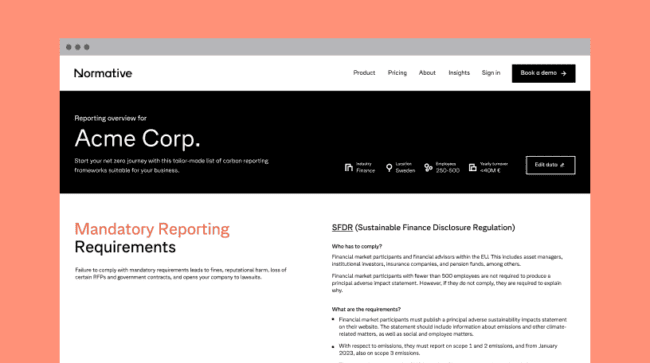

Our free Carbon Legislation Tracker will reveal your legally-mandated reporting requirements. It will also suggest relevant reporting frameworks and standards your business can use to meet climate disclosure expectations from investors and customers.

Learn your business’s reporting requirements

How can my business report its carbon?

To report your carbon emissions, you will first need to calculate them using a process known as carbon accounting. Like financial accounting, carbon accounting quantifies the impact of an organization’s business activities – though instead of financial impact, it tracks climate impact.

Using carbon accounting, you can calculate your business’s carbon footprint and understand where your emissions come from. This, in turn, enables you to report your sustainability impact to governments and stakeholders – as well as implement carbon reduction, and seize competitive advantages like increased brand equity.

Carbon accounting, explained

Carbon accounting empowers your business to achieve net zero emissions & comply with reporting legislation. Learn more in our comprehensive explainer article.

Read the article

What are the main carbon reporting legislations?

There is a variety of carbon reporting legislation around the globe, with varying demands related to formats and emissions scopes coverage. Below, find some of the most widely-applicable reporting legislation and a summary of their requirements:

CSRD (EU)

Adopted by the European Commission in November 2022, the CSRD replaces and builds on the Non-Financial Reporting Directive (NFRD) by introducing more detailed reporting requirements and expanding the number of companies that have to comply.

All large enterprises that do business in the EU – including those based outside of the EU – will need to disclose their emissions starting in 2024, including scope 3 value chain emissions.

SFDR (EU)

The Sustainable Finance Disclosure Regulation (SFDR) is an EU legislation that aims to increase the transparency of sustainability matters among financial actors.

The SFDR applies to financial market participants and financial advisors within the EU, including asset managers, institutional investors, insurance companies, and pension funds.

SECR (UK)

The UK’s Streamlined Energy and Carbon Reporting (SECR) policy requires organizations to share energy use and carbon emissions information in their annual reports. Its purpose is to widen the scope of energy and carbon reporting to a larger number of companies and to encourage energy efficiency actions.

The SECR applies to large enterprises, publicly-listed companies, and Limited Liability Partnerships (LLPs).

The SEC proposal (US)

Though it has not yet passed into law, the United States’ Securities and Exchange Commission has proposed a new rule to standardize climate disclosures for public companies.

The proposed legislation would require publicly-listed companies to disclose their carbon emissions, covering those that originate in scope 1, scope 2, and – in many cases – scope 3.

CSDDD (EU-driven, applies globally)

The CSDDD is a European Union directive aimed at enhancing the protection of the environment and human rights both within the EU and globally. It sets obligations for companies to address actual and potential adverse impacts on human rights and the environment, including those related to their own operations, their subsidiaries, and – vitally – their suppliers. Under the provisional agreement, large businesses would have to craft plans for reaching net zero.

EFRAG (EU)

Established in 2001, The EFRAG was appointed as the technical advisor to the Commission responsible for developing the ESRS (European Sustainable Reporting Standards). The EFRAG has released reporting requirements for 13 ESG (Environmental, Social, Governance) issues to ensure that sustainability information is reported in accordance with the CSRD.

About 50,000 EU enterprises will be required to produce ESG disclosures using the ESRS under the new CSRD regulations. All large businesses and listed businesses — with the exception of listed micro-enterprises — fall under this category. The first companies will be required to use the standards in the 2024 fiscal year for reports that are to be released in 2025.

NFRD (EU)

In order to assist investors, civil society organizations, consumers, policymakers, and other stakeholders in evaluating the non-financial performance of their companies, the EU approved the NFRD in 2014. Its main goal is to motivate businesses to report on their sustainability through openness and accountability.

The EU’s Non-Financial Reporting Directive (NFRD) applies to all companies with more than 500 employees, a balance sheet of EUR 20 million, or a net turnover of EUR 40 million. NFRD is set to be replaced by CSRD for the 2023 reporting year.

SDR (UK)

The SDR (Sustainability Disclosure Requirements) was designed to develop an integrated and simplified framework that consolidates sustainability reporting requirements for financial institutions and corporations.

UK-based funds and assets that want to market themselves as sustainable will need to meet a strict set of criteria once SDR is enforced. Rules for product labeling, initial disclosures, product name, and marketing take effect on June 30, 2024.

Normative empowers compliant reporting

Use Normative’s carbon accounting engine to produce accurate, comprehensive emissions calculations – then automatically export your data in reporting-ready formats.

FAQs

Frequently asked questions about carbon reporting legislation

Carbon reporting is, for many companies, legally mandated – and the number of businesses covered will expand even further in the next few years. Businesses that don’t comply risk hefty fines, reputational harm, and lawsuits. Additionally, non-compliant businesses may face the loss of government contracts, formal bids, or proposal requests.

For many EU businesses, carbon reporting is mandatory per theCSRD. All large enterprises that do business in the EU – including those based outside of the EU – will need to disclose their emissions starting in 2024, including scope 3 value chain emissions.

UK-based large enterprises, publicly-listed companies, and Limited Liability Partnerships (LLPs) are required to report their carbon emissions per theStreamlined Energy and Carbon Reporting (SECR) policy.