Carbon accounting, explained

Carbon accounting empowers your business to achieve net zero emissions & comply with reporting legislation.

Carbon accounting is a relatively new field, but it’s already become an essential tool in the fight against climate change.

Using carbon accounting, you can calculate your business’s carbon footprint and understand where your emissions come from. This, in turn, enables you to report your sustainability impact to governments and stakeholders, implement carbon reduction and removal, and build your brand equity.

Put simply: carbon accounting empowers your business to fight climate change, stay compliant, and seize business opportunities.

What is carbon accounting?

Carbon accounting is a way of calculating how much greenhouse gas an organization emits.

Like financial accounting, carbon accounting quantifies the impact of an organization’s business activities – though instead of financial impact, it tracks climate impact.

Also known as “greenhouse gas accounting,” carbon accounting is used to estimate carbon footprints for businesses, governments, and even individuals.

The foundations of carbon accounting can be traced back to Renaissance Italy – though carbon accounting as we know it today began in the early 2000’s.

A famous management adage says that “you can’t manage what you can’t measure.” Likewise, carbon accounting helps organizations understand their carbon emissions so they can identify hotspots, enabling them to begin their reduction efforts with high-impact actions.

And even when an organization has reduced its carbon as much as possible, calculating its carbon footprint will still help it estimate its residual emissions. The organization can then use climate investment to compensate its remaining emissions, completing its journey to net zero.

Along the way, organizations will want to share their progress with stakeholders like customers, investors, and employees – or they may even be required to report their emissions by law. Carbon accounting enables companies to report their climate impact.

The Carbon Glossary

Our Carbon Glossary explains the most common carbon accounting terms, abbreviations, and frameworks.

How carbon accounting works

What is required for carbon accounting?

Carbon accounting requires two things: data collection and data processing. To account for their emissions effectively, businesses need to ensure that their data collection is comprehensive, and that their data processing methodology is sound.

Data

Carbon accounting relies on two sets of data: business data and emissions factors.

Business data describes the activities performed by a business. This can be either:

- Spend data – how much money was paid to company X for a certain good or service, or

- Activity data – how many liters of fuel or kilograms of material were bought.

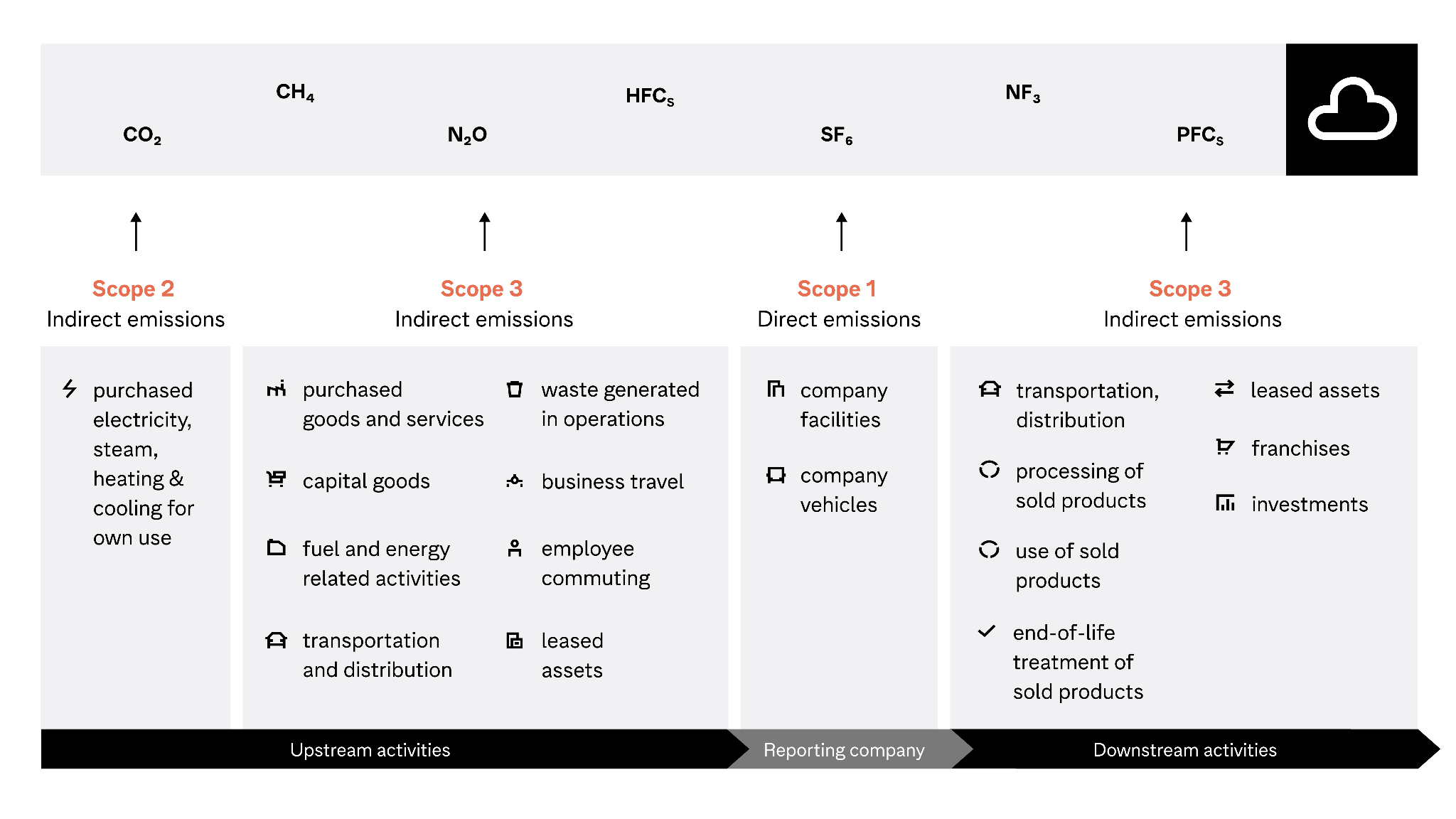

The infographic below shows the business data required to calculate a business’s full carbon emissions, including upstream and downstream sources:

Emissions factors are the second type data required for carbon accounting. They specify the amount of greenhouse gas emissions associated with a given unit of business data.

Once all the needed data has been collected, it can be translated into emissions estimates. How this is accomplished varies based on the methodology used.

Methodology

Carbon accounting calculates an organization’s greenhouse gas (GHG) emissions using two methodologies: spend-based and activity-based. The hybrid methodology combines spend-based and activity-based methods.

The spend-based method of calculating GHG emissions takes the financial value of a purchased good or service and multiplies it by an emission factor – the amount of emissions produced per financial unit – resulting in an estimate of the emissions produced.

Spend-based emission factors are typically derived from so-called environmentally extended input-output (EEIO) models that depict the flow of resources between different sectors of the economy. Based on this, one can calculate the average amount of emissions associated with each unit of money paid to a company in some specific industry and region.

Since spend-based methods’ emission factors are built on the industry average greenhouse gas emissions levels, spend-based calculations can lack specificity.

For example: if you buy a chair, a spend-based approach would only factor in that you bought a piece of furniture, and wouldn’t account for whether the chair was made of iron or wood.

The activity-based method uses data to specify how many units of a particular product or material that a company has purchased. For example, it could be liters of fuel, kilograms of textile, etc.

Like the spend-based method, the activity-based method also uses emissions factors to determine an activity’s emissions output. These emission factors are often taken from scientific studies.

In carbon accounting, activity data generally allows for more accurate emissions estimates than spend-based data. But it’s not as readily available as spend-based data, and can be time-consuming to gather.

Thus, the hybrid model methodology is recommended by the Greenhouse Gas Protocol, the most widely-used carbon calculation standard. Its pragmatic approach involves using all of the activity-based data possible, then using spend-based methods to estimate the rest.

The outputs from carbon accounting

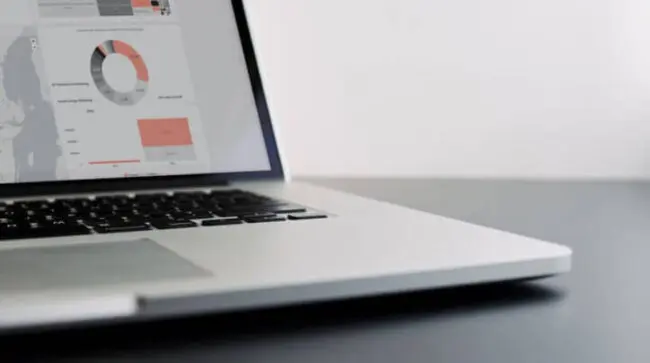

Carbon accounting gives an organization an estimate of its carbon footprint.

The accuracy of this estimation depends on the comprehensiveness of the emissions sources calculated, the quality of the spend and activity data inputs, and the precision of the emissions factors used.

While accurate emissions data is vital for reaching net zero, businesses should not let imperfect initial calculations stop them from taking action. Even rough emissions estimates can help identify areas for improvement and set goals for emissions reduction. For businesses, the aim is to always be as accurate as they can be given where they are in their carbon accounting journeys.

Emissions estimates are often broken down into emissions “scopes,” based on where the emissions originated from. There are three scopes defined by the Greenhouse Gas Protocol:

Why should my business use carbon accounting?

Reduce your carbon footprint

Carbon accounting is an essential tool for any business that wants to reduce its carbon footprint – which, in addition to fighting climate change, also helps businesses attract customers, investors, and employees.

Because you can’t manage what you can’t measure, calculating carbon emissions is the first step toward reducing emissions, enabling your businesses to switch to lower-carbon activities or materials. But calculating emissions – especially value chain emissions – can be a difficult task, involving collecting many kinds of data from many sources and then translating that data into emissions totals.

Using a software that automates the process will save your business significant time compared to trying to achieve the same in-house or through sustainability consultants.

And the less time you spend data-hunting, the earlier you can begin developing and implementing reduction strategies.

See carbon accounting in action

Flying Tiger Copenhagen used carbon accounting to discover hidden emissions hotspots, earn SBTi approval for its targets, and begin making reductions.

Go to the customer story

For enterprise businesses, carbon accounting is especially valuable in the value chain: the smaller businesses that provide the services, products, and resources that go into the enterprise’s end products.

These value chain emissions are a large part of a business’s carbon footprint (on average accounting for 92%[CDP]) but don’t originate directly from the company, which makes them tricky to calculate and reduce. Enterprise businesses, which have suppliers numbering in the thousands, face particular difficulties calculating value chain emissions.

By using a hybrid methodology, enterprises can do a spend-based carbon footprint estimation to gain an initial overview of their value chain’s emissions sources, then refine the estimate by collecting activity-based data from their biggest emitters. This carbon accounting-enabled top-down approach ensures that businesses, and especially big businesses, can begin with the highest-impact reductions.

Reducing value chain emissions: a practical guide

Our comprehensive guide explains how to engage your value chain in carbon reduction.

Get the guide

Meet sustainability reporting requirements

For businesses in many parts of the world, sustainability reporting is swiftly becoming a legal requirement.

Carbon accounting enables businesses to meet the climate impact reporting requirements of these current and future legislations.

At Normative, we’ve seen from experience that the businesses who start preparing for carbon reporting early face the fewest hassles come reporting time.

The sooner you begin, the smoother the process will be. The most savvy businesses are already getting their carbon accounting in shape for future reporting requirements. Our four-step plan for carbon reporting will help you take your organization from zero to compliance.

Learn your carbon reporting requirements

Answer five simple questions to determine the mandatory reporting requirements, voluntary frameworks, and industry-specific guidelines that apply to your business.

Go to the Carbon Legislation TrackerEarn competitive advantages

Companies that use carbon accounting also discover unexpected – and under-utilized – business benefits. These include minimizing risk, building brand equity, and reducing inefficiency.

Minimize risk

We tend to think of greenwashing as intentional – and nefarious. In traditional examples, a company tries to trick consumers into believing it’s doing environmental good when it’s actually doing harm.

But in fact, many businesses are greenwashing without realizing it. With unintentional greenwashing, an organization believes that it’s being environmentally responsible and communicates as such. But, unbeknownst to them, their environmental efforts are less effective or less comprehensive than they believe.

Unintentional greenwashing often begins at the first step of an organization’s climate action: its carbon footprint calculation.

According to a 2021 survey from Boston Consulting Group, businesses estimate an average error rate of 30% to 40% in their emissions calculations. This is the accuracy gap: the delta between the emissions an organization thinks they’re producing and the emissions they’re actually producing.

The accuracy gap is one of the five most common greenwashing traps, because any action based on incomplete information will have incomplete results. This makes the accuracy gap a business liability – and comprehensive, accurate carbon accounting a risk mitigation necessity.

Build brand equity

While compliance and risk reduction are driving forces for many companies, savvy businesses are using carbon accounting to go beyond box-ticking to create business value.

Consumers, employees, and investors increasingly demand businesses to take climate responsibility. Your business can appease these demands by sharing your climate journey.

Using carbon accounting to take demonstrable climate action – and validate your results – will help you build brand equity and protect it from allegations of greenwashing.

Reduce inefficiency

Quantifying your business’s entire operational footprint enables you to identify inefficiencies, especially those in your value chain.

For example, the Scandinavian telecom services company Eltel used its carbon accounting results to optimize the driving routes for its technicians, minimizing time costs while saving fuel – and, of course, reducing carbon emissions.

Used properly, carbon accounting can be the gateway to the circular economy for your business.

In summary

- Carbon accounting empowers your business to reach net zero emissions and report its climate impact.

- Carbon emissions calculations can be performed using spend-based data or activity-based data, or with a hybrid method that combines the two.

- As governments around the world move to require climate impact reporting, carbon accounting is quickly becoming an essential tool for keeping businesses legally compliant.

Carbon accounting with industry-leading accuracy

Normative’s carbon accounting engine uses over 30 million data points to calculate your business’s full emissions. Use Normative to keep your business compliant, competitive, and equipped to reach net zero.

FAQs

Carbon accounting methods include the spend-based and activity-based methods described by the Greenhouse Gas Protocol. Often, a blend of these two methods – called the hybrid method – is used to maximize the accuracy and comprehensiveness of carbon calculations.

Carbon accounting can be a complex and time-consuming process, especially for large businesses with complex value chains. Using software-based carbon accounting can simplify and speed up the process by helping with data collection and automating the data processing.

Carbon accounting is vital for enabling businesses to meet climate goals, stay compliant with carbon reporting legislation, and build brand equity.

To begin carbon accounting, find a carbon accounting provider that suits your business’s needs. Normative has developed the world’s first carbon accounting engine, which uses 30 million data points to calculate businesses’ full carbon footprints.